Article

At-Bay Stance MDR Builds on InsurSec With the Security Standard Enterprises Trust

InsurSec leader makes enterprise-level cybersecurity affordable for emerging and mid-size businesses

It’s nearly impossible for small and mid-size businesses to keep up with rapidly evolving vulnerabilities and threats. When attacked by cybercriminals who are exploiting holes in software they purchased from giant tech vendors, these businesses are often left to pick up the pieces on their own with little support.

Sophisticated security solutions are expensive and complex to manage. The largest companies can afford to hire experts and employ leading technologies like Endpoint Detection and Response (EDR). Managed Detection and Response (MDR) combines EDR with outsourced, expert-level security personnel, allowing enterprises to reduce IT costs while maintaining a high level of security.

“At-Bay claims data show more than 50% of cyber insurance claims over the past two years could have been mitigated or even stopped altogether by an MDR solution.”

Based on At-Bay analysis of At-Bay claims from Q4 2021 thorough to Q3 2023 that could potentially have been mitigated by a Managed Detection and Response product.

For many small businesses, the level of security MDR provides has remained out of reach, as it often comes with a hefty price tag. Many are still using outdated antivirus software that is inadequate against modern threats (often orchestrated by nation states).

With that in mind, we’re introducing At-Bay Stance™ MDR to help our customers proactively manage their cyber risk and bridge their security gaps. By combining our insurance expertise and world-class cybersecurity team with a market-leading Endpoint Detection and Response (EDR) solution, we can deliver enterprise-level security technology and expertise at a price smaller businesses can afford.

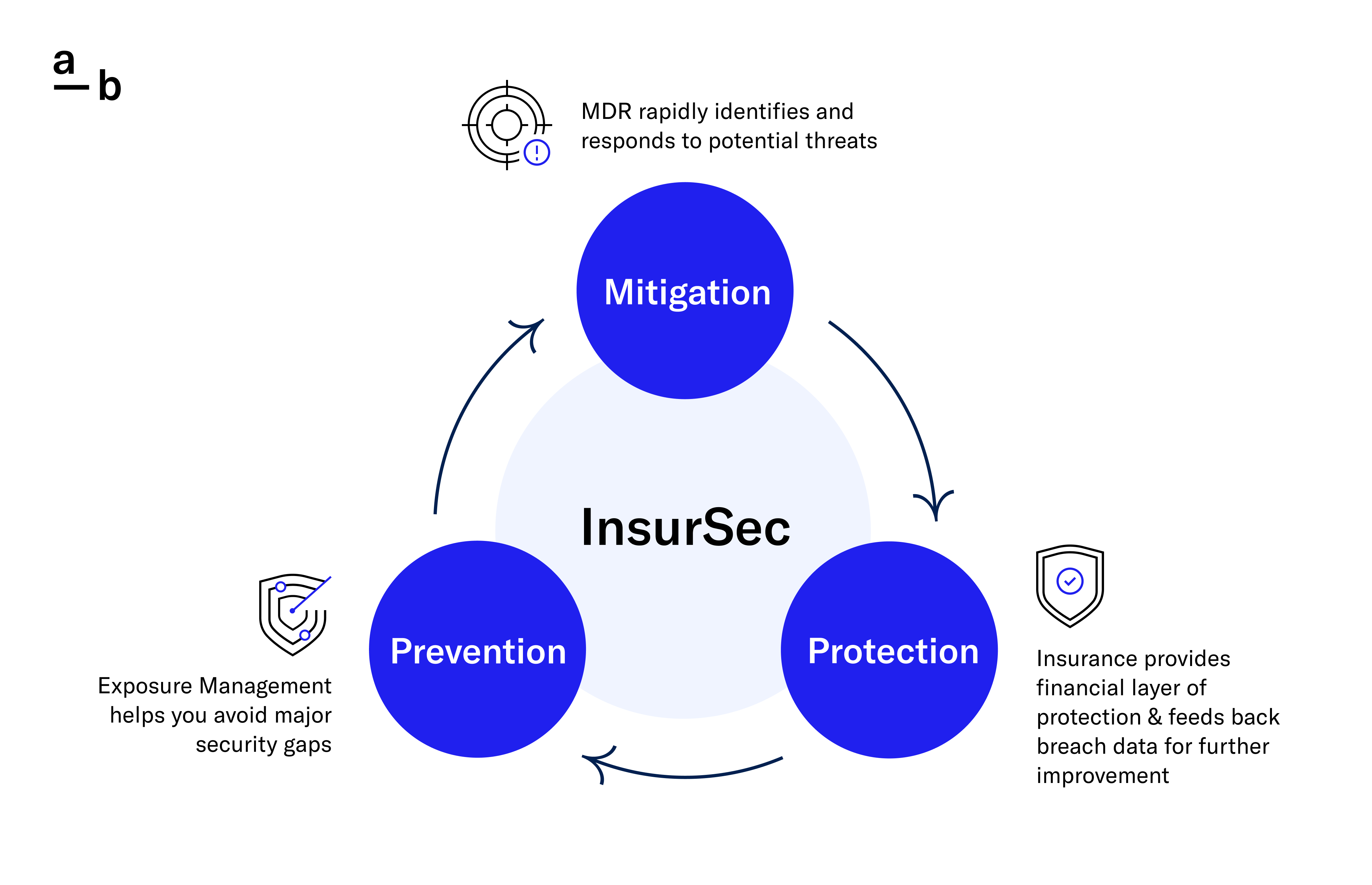

Utilizing InsurSec to Keep Pace With Cyber Threats

As the leader in InsurSec, At-Bay helps small businesses defend from cyber threats not just with an insurance policy, but with an end-to-end approach that combines insurance and security now available on the world’s first InsurSec platform, At-Bay Stance. As the insurance provider, we encourage improved security that has proven to minimize loss, such as MDR. Improved security makes a company a better risk, which makes it potentially eligible for a premium credit, which may substantially reduce the cost of insurance.

MDR from At-Bay is an optional security solution (it is not a prerequisite for obtaining a policy from At-Bay), it is a significant security improvement that can bring together the best of InsurSec.

“In a recent survey of over 500 small businesses, approximately half said their two biggest cybersecurity challenges are keeping up with changing threats and lack of time to focus on security1.”

Meet At-Bay’s MDR Solution

At-Bay Stance MDR doesn’t only resolve threats after they’ve emerged — it provides prevention, spotting unusual patterns and thwarting attacks before they can spread within the network. Using an MDR solution reduces the risk of crippling data breaches or ransomware attacks, while also lightening a business’s security demands by outsourcing threat detection and management to experts.

With powerful software and human expertise, here’s more about how the solution works:

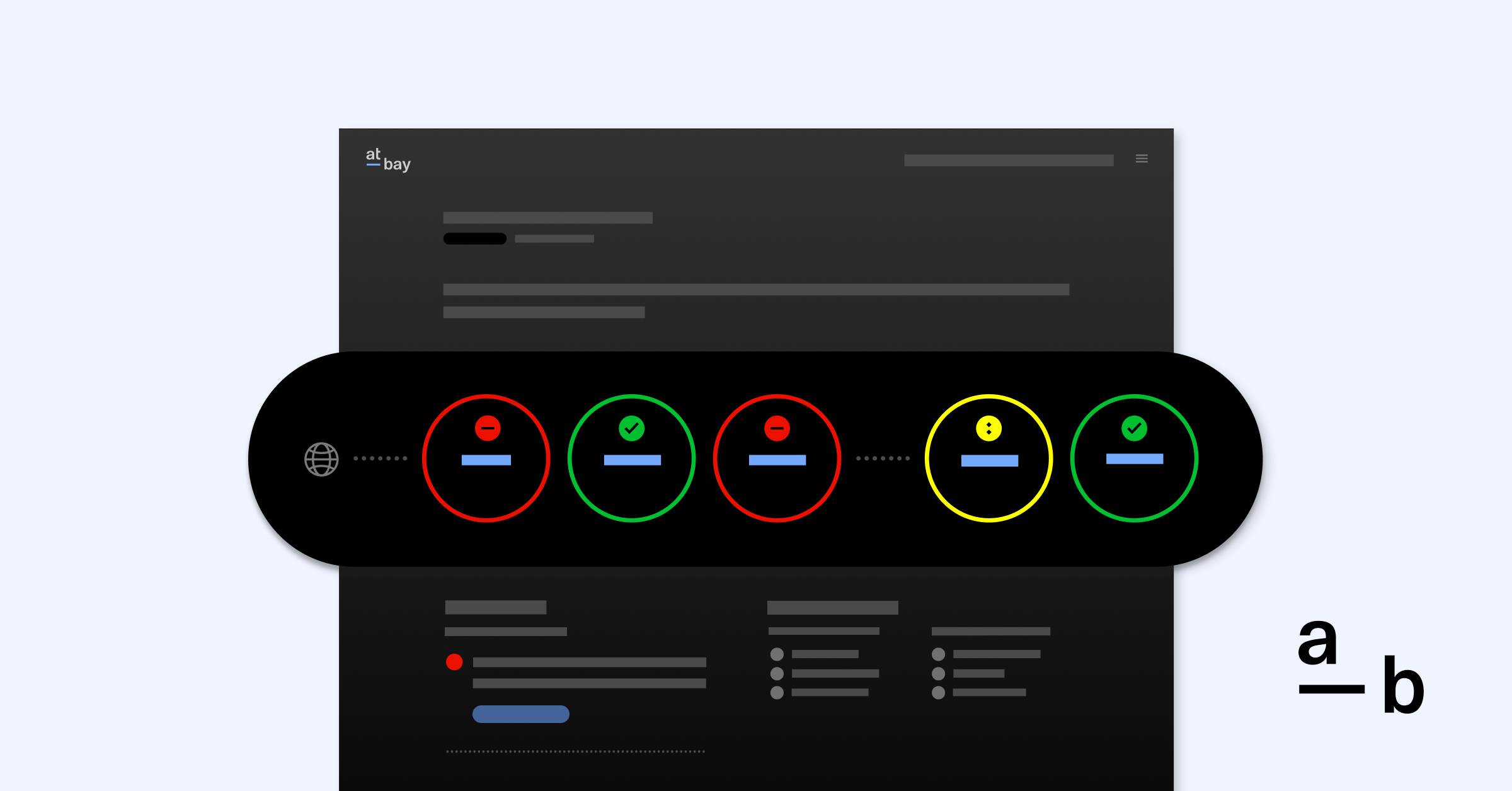

Threat Detection Software: The foundation of At-Bay Stance MDR is the Endpoint Detection and Response (EDR) solution, which monitors, detects, and counters threats on devices that connect to an organization’s network (e.g., computers, smartphones, and tablets). In order for At-Bay’s policyholders to get the best protection possible, we’re deploying the same software in use at Fortune 500 companies.

Cybersecurity Experts: At-Bay’s world-class Security team manages this EDR service for customers. These experts perform around-the-clock monitoring of users’ networks, providing rapid threat containment and response — freeing small businesses from building every aspect of their security strategy from scratch.

InsurSec is a Game Changer for Small Businesses

With the introduction of At-Bay Stance MDR to the market, we are helping make businesses of all sizes safer. That benefits everyone: the customer, the insurance broker, the carrier, and the reinsurers.

At-Bay’s claims data indicates that MDR can significantly reduce cyber risk. For most small businesses the cost of EDRs alone, not to mention an in-house or third-party security team to manage it, makes MDRs non-viable. Our claims data indicates that insureds with MDR like At-Bay Stance MDR, should see fewer losses. Fewer losses and better security, typically translate to lower insurance costs through potential premium discounts. At-Bay enjoys the expertise and scale to offer an affordable MDR solution that small businesses can’t afford or access directly.

Footnotes