Article

Get Protection from Phishing Attacks with Cyber Insurance

This common form of social engineering can wreak havoc on businesses

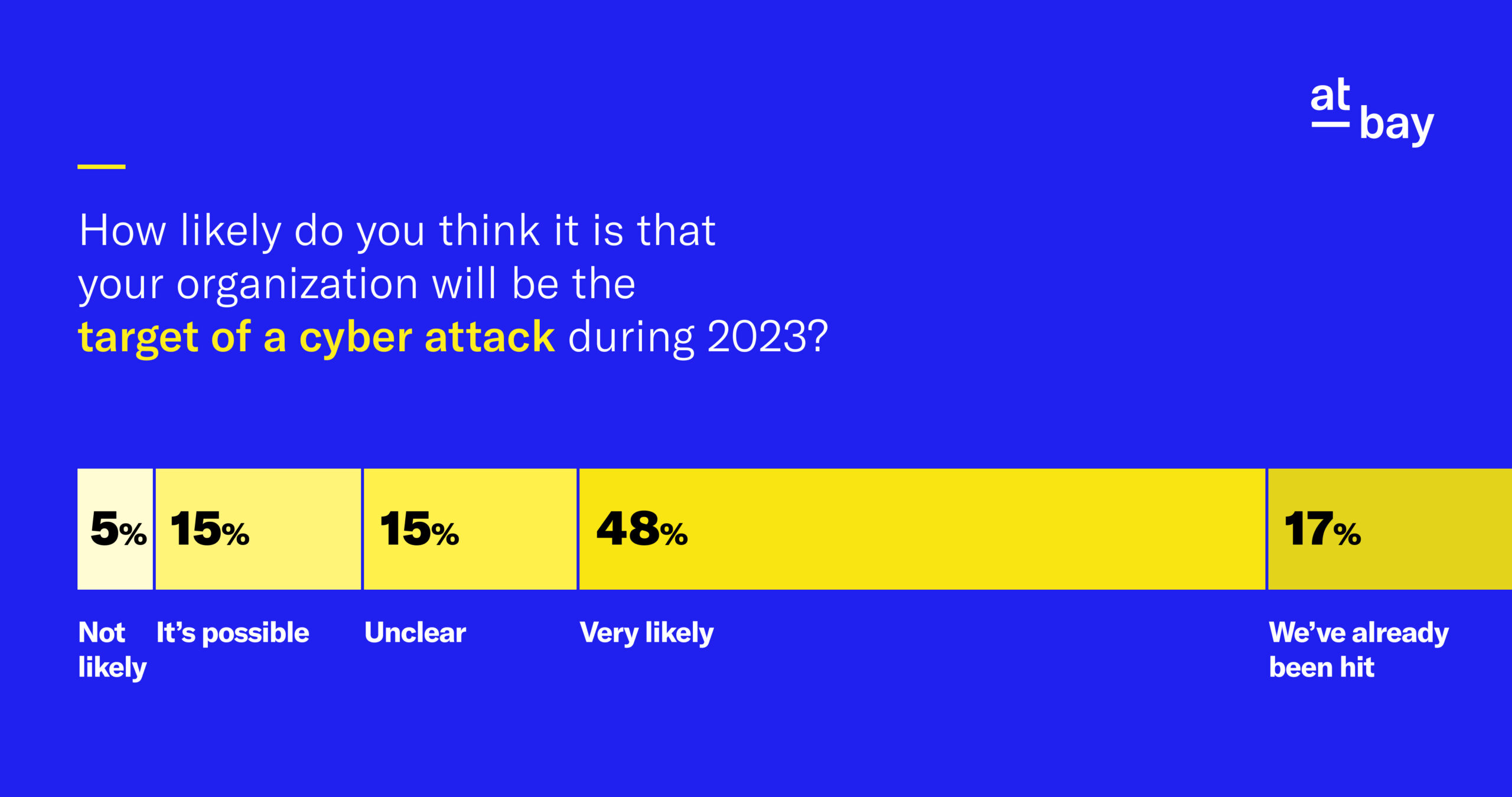

Phishing attacks have become some of the most prevalent and damaging forms of cybercrime in recent years. These attacks aim to deceive victims into revealing sensitive information such as passwords, bank account details, or other personal details.

Cyber incidents at large enterprises often make headlines, like the sophisticated phishing-originated ransomware attack that impacted The Guardian in 2022. The abundance of news coverage can lead to the false perception that only big businesses are at risk of this type of attack. However, small businesses actually deal with phishing attempts as frequently as, if not more often than, their larger counterparts. For example, cybercriminals targeted a variety of micro-businesses operating on social media platforms with phishing attacks in 2023.

Cyber insurance policies that include comprehensive coverage against phishing can help businesses overcome this growing threat. Here’s what you need to know about phishing attacks, prevention strategies, the importance of protection, and the coverage available through a cyber insurance policy.

Understanding Phishing Attacks

Phishing, a form of social engineering attack, involves a malicious attempt to trick victims into sharing confidential information, which can result in identity theft, financial losses, and other serious consequences. Typically, the attacker poses as a trusted entity — like a financial institution, vendor, partner, or client — to manipulate victims into opening fraudulent emails or texts, clicking on harmful links, revealing account login credentials, or providing sensitive data like credit card numbers or financial information.

Phishing attacks commonly involve the following techniques:

- Spoofed Emails: Attackers send emails that appear to be from legitimate sources, closely replicating the branding and email accounts of reputable organizations. These emails often contain enticing messages or urgent requests that prompt the recipient to take immediate action, like clicking on a link that downloads malware or providing personal information.

- Phishing Websites: Fake websites that imitate legitimate platforms, such as banking portals or online stores, aim to trick users into entering their login credentials or financial details so attackers can steal them.

- Spear Phishing: This targeted form of phishing involves personalized attacks against specific individuals or organizations. Cybercriminals conduct thorough research to gather information about their targets, then craft highly convincing messages that appear to come from trusted sources or acquaintances.

- Smishing and Vishing: Phishing attacks have expanded beyond emails, and now encompass SMS phishing (smishing) and voice phishing (vishing). These methods involve sending deceptive text messages or making phone calls to trick individuals into revealing sensitive information or performing desired actions.

Phishing attacks leverage social engineering techniques to exploit human psychology and play on emotions like fear, urgency, curiosity, or trust, compelling victims to disclose private information or follow malicious instructions. Alongside ransomware, phishing and other types of social engineering are some of the most common forms of cyberattacks modern businesses face.

How to Prevent Phishing at Your Organization

Prevention is the first line of defense against phishing scams. By implementing proactive measures, businesses can significantly reduce the risk of falling victim to these fraudulent schemes. Here are a few key prevention strategies:

Train Employees on Spotting Phishing Attempts

A well-trained workforce is the first line of defense in protecting any business against phishing attacks. Conduct regular training sessions to educate employees about the latest phishing techniques, how to identify suspicious emails or text messages, and what actions to take if they suspect a phishing attempt.

By staying vigilant and recognizing the signs of phishing, such as suspicious email addresses, spelling mistakes, or unusual request patterns, individuals can avoid falling victim to these malicious schemes and safeguard the company’s non-public information.

Implement a Password Policy and MFA

Even the best-trained employees can make mistakes, which is why it’s crucial to enforce a strong password policy that mandates the use of complex, unique passwords and regular updates. Additionally, implement multi-factor authentication (MFA) on all business accounts to add an extra layer of security. MFA requires users to provide additional verification, such as a unique code sent to their mobile device, before accessing sensitive information or systems. This significantly reduces the risk of unauthorized access if credentials are compromised.

Create an Anti-Phishing Policy

Establish a comprehensive anti-phishing policy that outlines guidelines and protocols for your employees to follow. This policy should include procedures for verifying emails, reporting suspicious activities, and responding to potential phishing incidents. Regularly communicate and reinforce the policy to ensure it remains top-of-mind for all employees.

Use Anti-Phishing Tools

Leverage technology to enhance your organization’s defenses against phishing attacks, such as:

- Browser add-ons or extensions to detect and warn users of suspicious websites or suspected phishing emails

- Email filtering or secure email gateways (SEGs) to identify and block phishing emails before they reach users’ inboxes

- Firewalls and advanced threat detection systems to proactively identify and mitigate phishing attempts

- Antivirus software to identify and block malicious websites, emails, or attachments that are known to be associated with phishing attacks

- Domain Name System (DNS) filtering services to block access to known phishing websites

Additionally, maintain a rigorous schedule for updating software, applications, and security systems to address known vulnerabilities exploited by phishing attacks. Patch regularly to reduce the risk of attackers exploiting security weaknesses and gaining unauthorized access and stay ahead of evolving phishing techniques.

Partner With an InsurSec Provider

To get prevention and protection that work together, look for an InsurSec provider that not only offers insurance coverage in case things go wrong but can also help you maintain a strong cybersecurity posture throughout your policy. Finding a provider who combines security with insurance means less time spent assessing and managing one-off security solutions, and it helps your budget stretch further since your insurance costs include security.

The Importance of Phishing Protection

Even with the best preventive measures in place, phishing attacks can still occur. While employee training goes a long way and security measures can help protect against known attack methods, sophisticated attackers can use spear phishing methods to craft personalized messages that evade detection by security tools and fool users into disclosing private information.

On top of that, anti-phishing tools are not foolproof and are often reactive, meaning they may not be enough to protect against novel or evolving attacks. Human error also remains a risk factor despite training and awareness programs, and users may still fall for phishing scams despite training and awareness programs, either due to a lack of attention or misleading messages that induce a sense of urgency.

The consequences of falling victim to a phishing attack can be severe — according to the NetDiligence Cyber Claims Study 2023 Report, the average cost of a phishing attack between 2018-2022 for small to medium-sized businesses (defined as those with less than $2B in annual revenue) was $60K. This only represents the financial losses, which can accompany numerous other ramifications ranging from data breaches and reputational damage to compromised computer systems and legal/regulatory consequences.

Phishing Coverage through Cyber Insurance

Phishing attacks pose a significant threat to businesses of all sizes. Prevention strategies play a vital role in mitigating risk, but comprehensive cyber insurance coverage is equally essential. By investing in a cyber insurance policy that provides strong protection for social engineering and financial fraud, businesses can ensure they are prepared to handle the financial and operational consequences of a phishing attack.

Cyber insurance with social engineering and/or financial fraud coverage that includes phishing can help with various aspects of a phishing attack, including forensic investigation costs, legal expenses, data breach notification, and liability from compromised customer information.

As an InsurSec provider, At-Bay can help policyholders strengthen their defenses against phishing and other types of attacks, and our comprehensive Cyber insurance policies include social engineering and financial fraud coverages to help your business recover quickly and efficiently in the event of an incident.

Learn more about Cyber insurance from At-Bay →

Note: This information may not be used to modify any policy that might be issued, modify an existing policy, or imply that any claim is covered. For specific terms and conditions, please refer to the coverage form.