Article

Technology Errors and Omissions vs. Cyber Insurance

Understanding which coverage your business needs

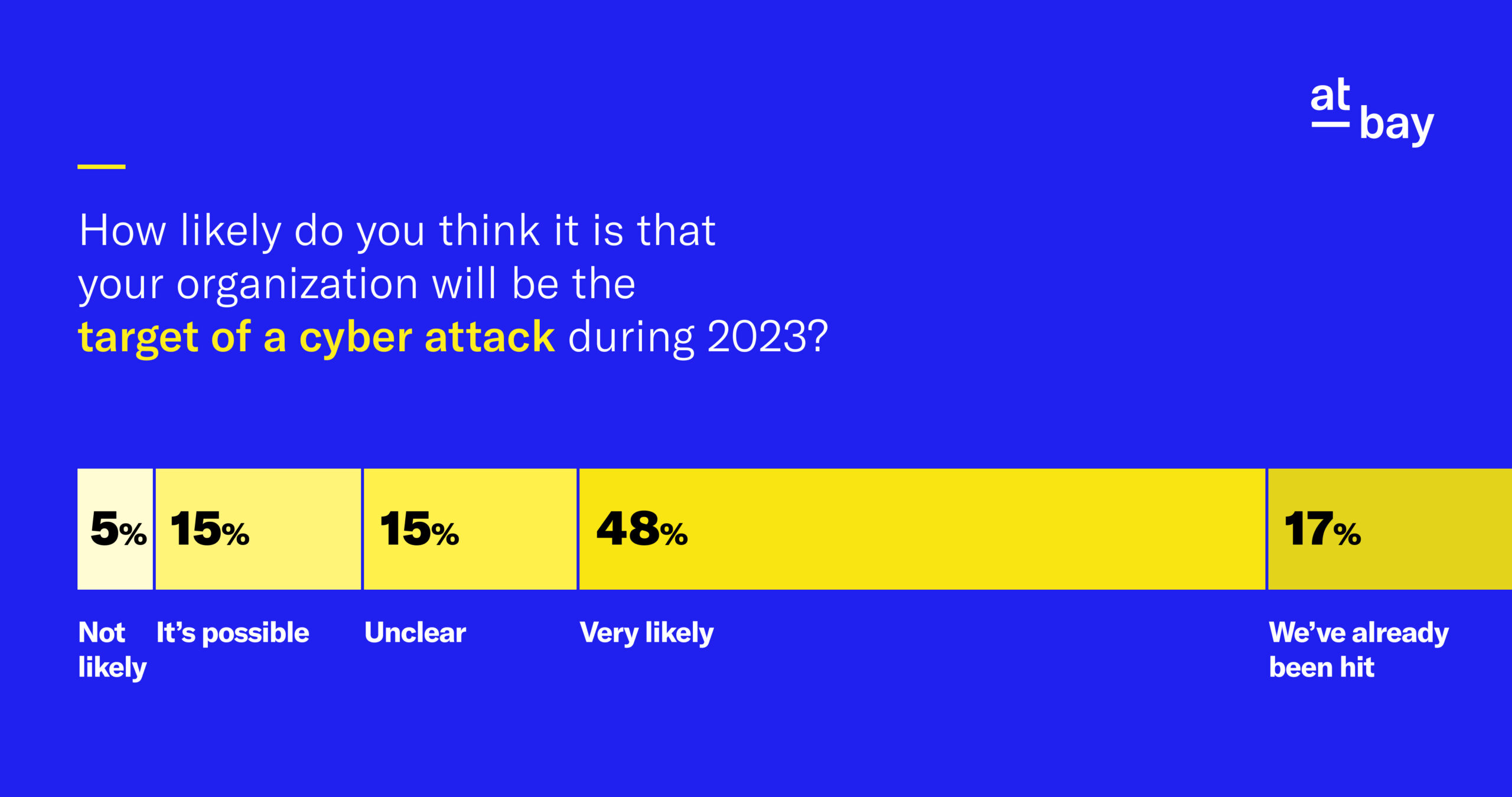

Modern businesses face a multitude of risks, with cyber threats looming large among them. As your business navigates the ever-evolving technology landscape, it’s crucial that you understand what type of insurance coverage is needed to safeguard your assets.

You may be curious about the differences between cyber and tech E&O insurance, which both address cyber risk but are not interchangeable. Here’s a rundown detailing the key distinctions between these two types of insurance, what each covers, and how they can work independently or in tandem to help protect your business from digital risk.

What is Cyber Insurance?

Cyber insurance provides a safety net for businesses to mitigate the serious financial and reputational risks associated with cyber incidents. It is designed to protect businesses from the fallout of a cyberattack, data breach, or other cyber-related incident.

Businesses that handle sensitive customer data, engage in online transactions, use cloud-based services, rely on digital infrastructure, or simply have an online presence are at heightened risk for cyberthreats. Additionally, businesses that depend on interconnected supply chains, employ remote workers, or lack robust cybersecurity measures may be at higher risk of cyberattacks.

Having cyber insurance provides financial protection and support in the event of a covered incident, helping businesses react, recover, and mitigate potential losses. There are various types of cyber insurance coverage, including first-party coverage, third-party coverage, and financial fraud.

Policies typically cover a spectrum of risks, which may include:

- Data Recovery: Reimbursement for expenses incurred in restoring or recovering compromised or lost data and coverage for the costs of rebuilding and reconfiguring systems to prevent future incidents.

- Business Interruption: Reimbursement for income lost during downtime caused by a cyber event.

- Digital Forensics and Incident Response (DFIR): Coverage for the costs associated with investigating the cause and extent of a cyber incident, as well as financial support for hiring cybersecurity experts to assess the breach, identify vulnerabilities, and develop remediation plans.

- Legal Defense: Financial support for hiring legal professionals to defend against lawsuits and regulatory actions stemming from a cyber incident, plus coverage for financial settlements or judgments resulting from legal proceedings related to the cyber event.

- Reputational Harm: Support for engaging public relations experts to manage and mitigate reputational damage and coverage for expenses related to informing affected parties, including the creation and distribution of notifications.

Learn more in our introduction to cyber insurance →

What is Technology Errors and Omissions (Tech E&O) Insurance?

Technology errors and omissions insurance addresses a different facet of the risk landscape. This type of insurance is tailored to protect technology professionals and companies from claims related to professional negligence or failure to deliver promised services.

While cyber insurance is typically appropriate for businesses in any industry with an online presence, tech E&O coverage is specifically aimed at protecting businesses in the technology sector that provide technology-based professional services or products. This includes technology professionals, consultants, software developers, and IT service providers, who can be exposed to potential liabilities arising from errors, omissions, or failure to deliver promised services.

Tech E&O insurance is tailored to protect against claims of professional negligence, mistakes in the provision of services, or disputes related to intellectual property. In a rapidly evolving and highly competitive industry where client expectations are high, tech E&O insurance is a strategic risk management tool that safeguards against the financial consequences of unforeseen errors or oversights.

Coverage under tech E&O insurance may include:

- Breach of Contract Coverage: Addresses legal expenses and financial losses resulting from claims of failure to meet contractual obligations in addition to providing coverage for disputes arising from alleged breaches of contractual agreements with clients or stakeholders.

- Breach of Warranties: Protects against claims related to breaches of warranties or guarantees associated with the delivered technology solutions.

- Consequential Damages: Coverage for financial losses suffered by clients as a result of the insured’s technology products or services.

- Intellectual Property Infringement Coverage: Protection against claims of intellectual property infringement, including coverage for legal defense costs and potential settlements.

- Personal Injury Coverage: Coverage for claims of personal injury, including reputational harm or damage arising from statements made during the course of professional services.

- Comprehensive Negligence Coverage: Protection against claims of negligence, errors, or omissions in the provision of technology services.

- Contractual Indemnity Coverage: Addresses claims arising from contractual indemnity agreements, providing financial support for legal defense and indemnification responsibilities.

Key Differences Between Tech E&O and Cyber Insurance

The key differences between tech E&O insurance and cyber insurance lie in their scope and focus.

Tech E&O insurance primarily caters to technology professionals, software developers, and IT service providers, offering protection against claims related to professional negligence, errors in service delivery, and breaches of contractual obligations. It is indispensable for those in the technology sector who provide services or products, safeguarding them from the financial consequences of inadvertent mistakes.

Cyber insurance is more broadly applicable to businesses across various industries and is geared towards mitigating the fallout of cyber incidents. It covers expenses associated with data breaches, including investigations, legal defense, data recovery, and public relations efforts.

While tech E&O insurance provides protection against professional liabilities, cyber insurance focuses on addressing the aftermath of cyberattacks and data breaches. Businesses engaged in technology services may find value in both types of coverage, creating a layered defense against a spectrum of cyber risks, while non-technology industries will find value from cyber insurance and would not be eligible for tech E&O coverage.

Protect Your Business with Comprehensive Coverage Against Cyber Risk

Every business has unique risks, and choosing insurance is not a one-size-fits-all endeavor. Consider using our Cyber Risk Calculator to better understand your exposure and assess your risk profile.

At At-Bay, we understand the evolving nature of cyber threats and the need for tailored insurance solutions. Our comprehensive InsurSec offerings, including both Cyber and Tech E&O insurance, provide businesses with a holistic approach to managing cyber risk.

If you’re a broker looking to find the best coverage for your clients, explore At-Bay’s Broker Platform or reach out to your underwriter.

Coverage is subject to and governed by the terms and conditions of each policy as issued. This information may not be used to modify any policy that might be issued, modify an existing policy, or imply that any claim is covered. For specific terms and conditions, please refer to the coverage form.